What is identity verification?

Identity verification is the process of ensuring a person is who they are claiming to be. It’s a crucial part of doing business, and is essential for preventing fraud, financial crime, and complying with legal and regulatory requirements. At a time when so many transactions take place online, identity verification plays a crucial role in building digital trust, and can be accomplished using a variety of methods, from checking authoritative data sources, to using biometrics and document verification.

How do identity verification services work?

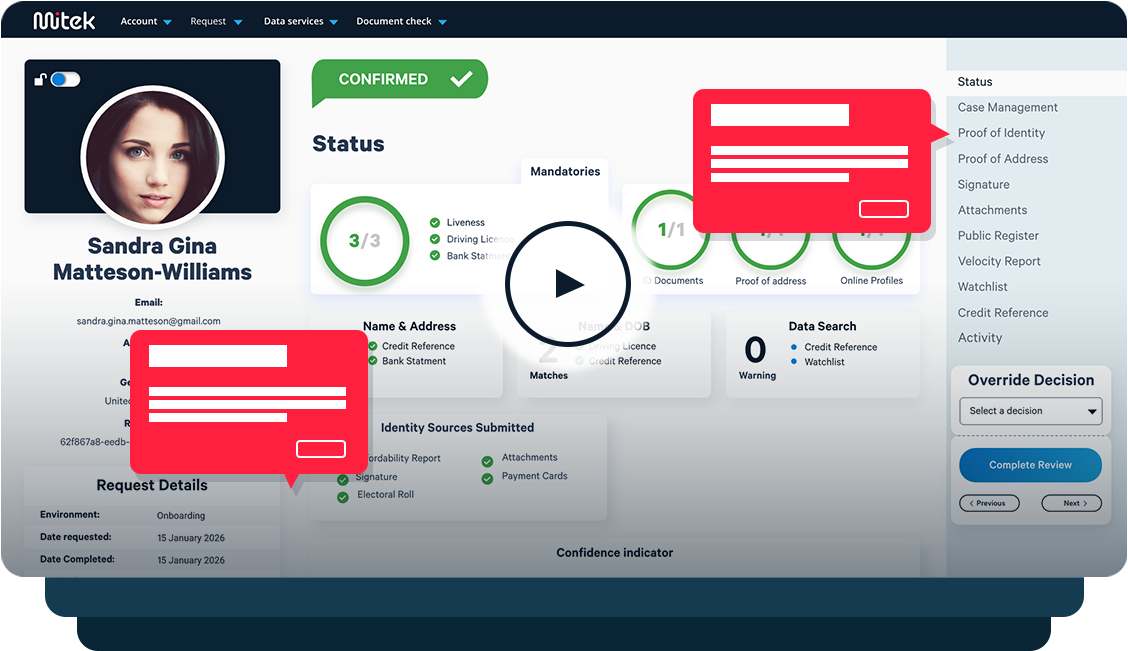

Identity verification services typically work by capturing personal information from an individual (sometimes extracted from a government-issued ID) and comparing it to trusted and authoritative data sources to ensure that a) the person exists and is a real person, b) there is a record of them that has existed over time, and c) the person claiming the identity is the actual owner of it. In addition, most identity verification services will provide other means of risk assessment in order to meet financial crime compliance guidelines (where required).

What is considered banking-grade identity verification?

The banking sector is heavily regulated, with extensive KYC, AML and good practice guidelines (e.g. GPG45 in the UK) in place to protect consumers and businesses against fraud, financial crime and terrorist financing. ‘Banking-grade’ identity verification refers to solutions that meet the rigorous regulatory standards imposed upon the sector. These systems typically involve multi-layered checks that can include document authentication, biometrics, risk assessments and more. The term has come to represent the highest benchmark for identity verification with regards to security, accuracy and compliance. The Mitek MiVIP platform is considered ‘banking-grade’, and the number of banks and financial institutions that can be counted as customers is a testament to that.

Why do banks/financial institutions/etc. choose MiVIP for an identity verification service?

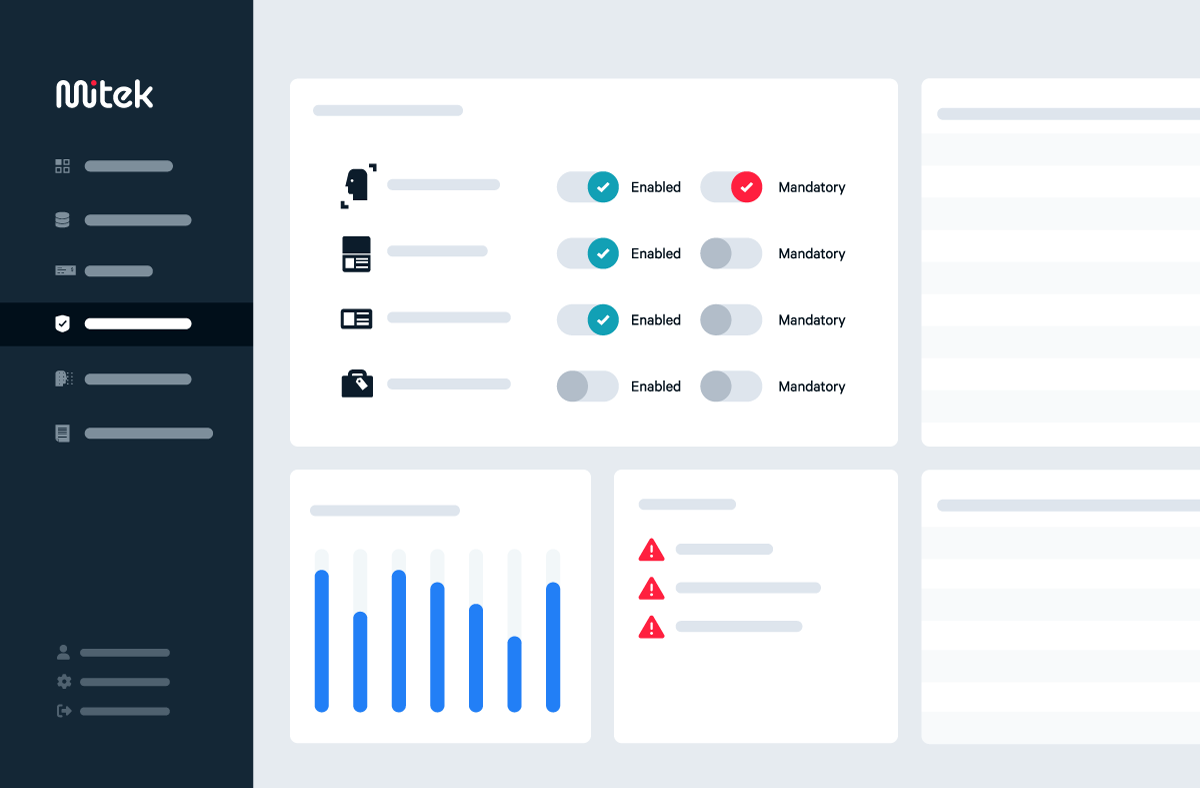

Banks and financial institutions choose MiVIP because it helps them meet the rigorous standards expected of them by regulators and consumers alike. It gives them complete flexibility and control of their identity verification solutions. Whether that’s to manage, configure and control a specialist identity solution (like document verification) that’s been integrated via an API into an existing customer journey(s), or to orchestrate layers of digital trust and fraud tools to find that optimal balance between strong fraud protections and simple customer experiences. Mitek’s ability to protect against even the most sophisticated AI fraud, like deepfakes and other manipulated content, plays an important role in meeting the highest regulatory standards.

What makes MiVIP the best digital identity verification solution?

MiVIP stands out as the best digital identity verification solution for:

- Its ability to connect identity verification and authentication. MiVIP can make it easier for businesses to use and manage biometrics beyond onboarding. With the selfie from the verification process (alongside additional voice recognition), they can create more secure, trusted processes for existing customers, like secure password-less login, or transaction authorization.

- It’s proficiency in detecting even the most complex and convincing AI-driven fraud with Digital Fraud Defender. The layered solution uses biometrics and sophisticated AI to protect against deepfakes and other AI-generated fraud, as well as the common attack types that go hand-in-hand with AI fraud, like injection attacks.

- It’s core flexibility. Allowing the platform to cater to the requirements of a variety of customers with different needs. It can be used to manage, configure and control specialist identity solutions (like document verification), as well as to orchestrate full identity journeys with layers of services.

- Its ability to scale in-line with customer demand (volume of verifications) and across geographies to support expansion plans and compliance in new jurisdictions.

Is MiVIP an online identity verification solution?

Yes, MiVIP is an online identity verification solution. It enables businesses to verify the identity of customers remotely. With a variety of options available to them, businesses can build an identity verification process that entirely suits their needs, giving their customers the freedom to complete the process from anywhere, through a mobile phone, laptop or other device. It makes it ideal for companies looking to provide seamless online customer experiences while maintaining high security and compliance standards.

Can MiVIP be customized?

Yes, MiVIP is incredibly flexible and can be customized in a variety of ways.

- As an orchestration platform customers can build identity journeys that are specific to their requirements, flexible to the risk of each consumer, and using a variety of tools, like data, documents, biometrics, fraud risk assessments or AML screening. Moreover, customers can build and host more than one journey on the MiVIP platform, to accommodate different requirements (perhaps different risk profiles, products or regions).

- The platform (the administrative user interface) and customer facing elements of the customer journey can also be fully branded. For example, the document verification and biometric user interface can be aligned to an individual business’s corporate branding, so that they seamlessly integrate as part of a wider onboarding journey. This branding can be controlled via the MiVIP platform, so customers have full control of this process.